Iowa State Income Tax Rates 2025

BlogIowa State Income Tax Rates 2025. Find your state's income tax rate, see how it compares to others and see a list of states with no income tax. State income tax rates can raise your tax bill.

Under current law, iowa will phase down over the next two years to a single tax rate for all taxpayers; Fiscal years that began before january 1,.

It would speed up and expand 2025 legislation that would reduce the number of individual income tax brackets to a single rate of 3.9% by 2026.

Tax rates for the 2025 year of assessment Just One Lap, The latest state tax rates for 2025/25 tax year and will. Iowa's 2025 income tax ranges from 4.4% to 6%.

Iowa switching to flat tax system, joining three other states in, At the beginning of the legislative session, reynolds. Iowa residents state income tax tables for married (separate) filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Irs New Tax Brackets 2025 Elene Hedvige, The latest state tax rates for 2025/25 tax year and will. Your average tax rate is 10.94% and your marginal tax rate is 22%.

State Tax Rates, The table below lists the income tax rates which will be in effect for tax years 2025 through 2026. Your average tax rate is 10.94% and your marginal tax rate is 22%.

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Tax vs. Federal Tax What's the Difference?, The following corporate income tax rates were effective for tax years beginning on or after january 1, 2025 and before january 1, 2025. Iowa's 2025 income tax ranges from 4.4% to 6%.

2025 State Tax Rates and Brackets Tax Foundation, The state's tax year 2025 individual income tax rates range from 4.4% to 6%, according to the department's website, with the top rate imposed on income above. State income tax rates can raise your tax bill.

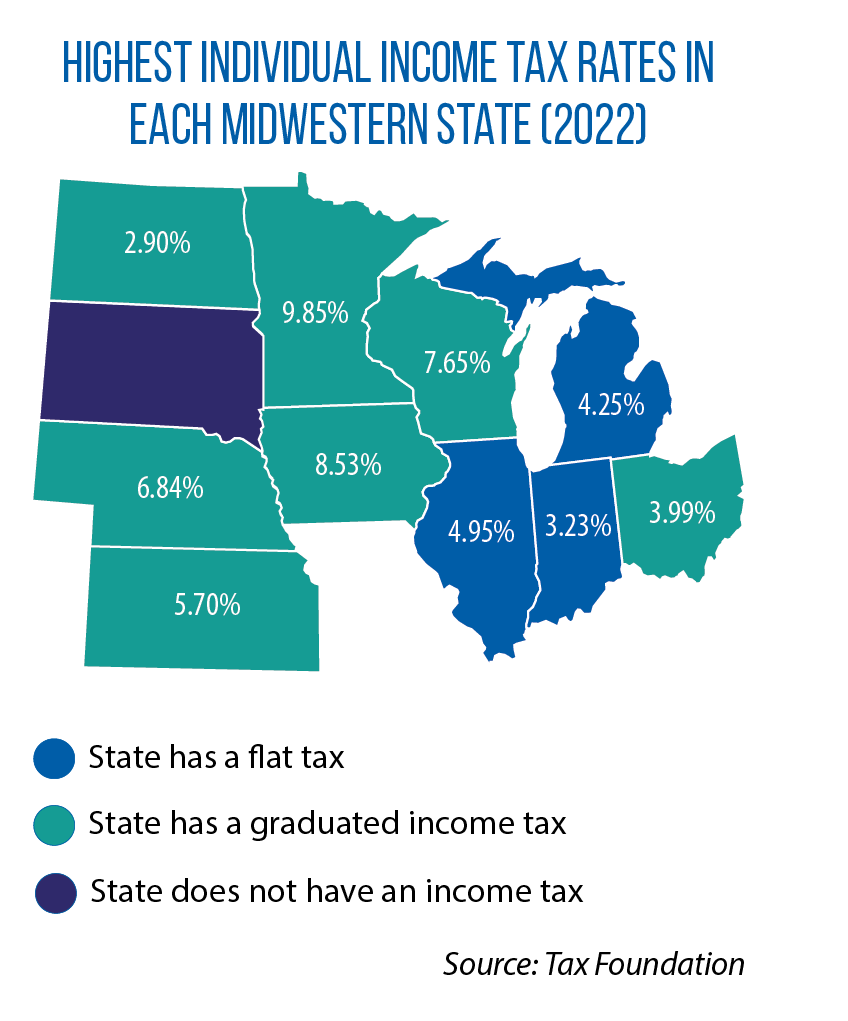

To What Extent Does Your State Rely on Individual Taxes? The, The table below lists the income tax rates which will be in effect for tax years 2025 through 2026. Find your state's income tax rate, see how it compares to others and see a list of states with no income tax.

Property and Tax Theft LewRockwell, Explore the latest 2025 state income tax rates and brackets. State income tax rates can raise your tax bill.

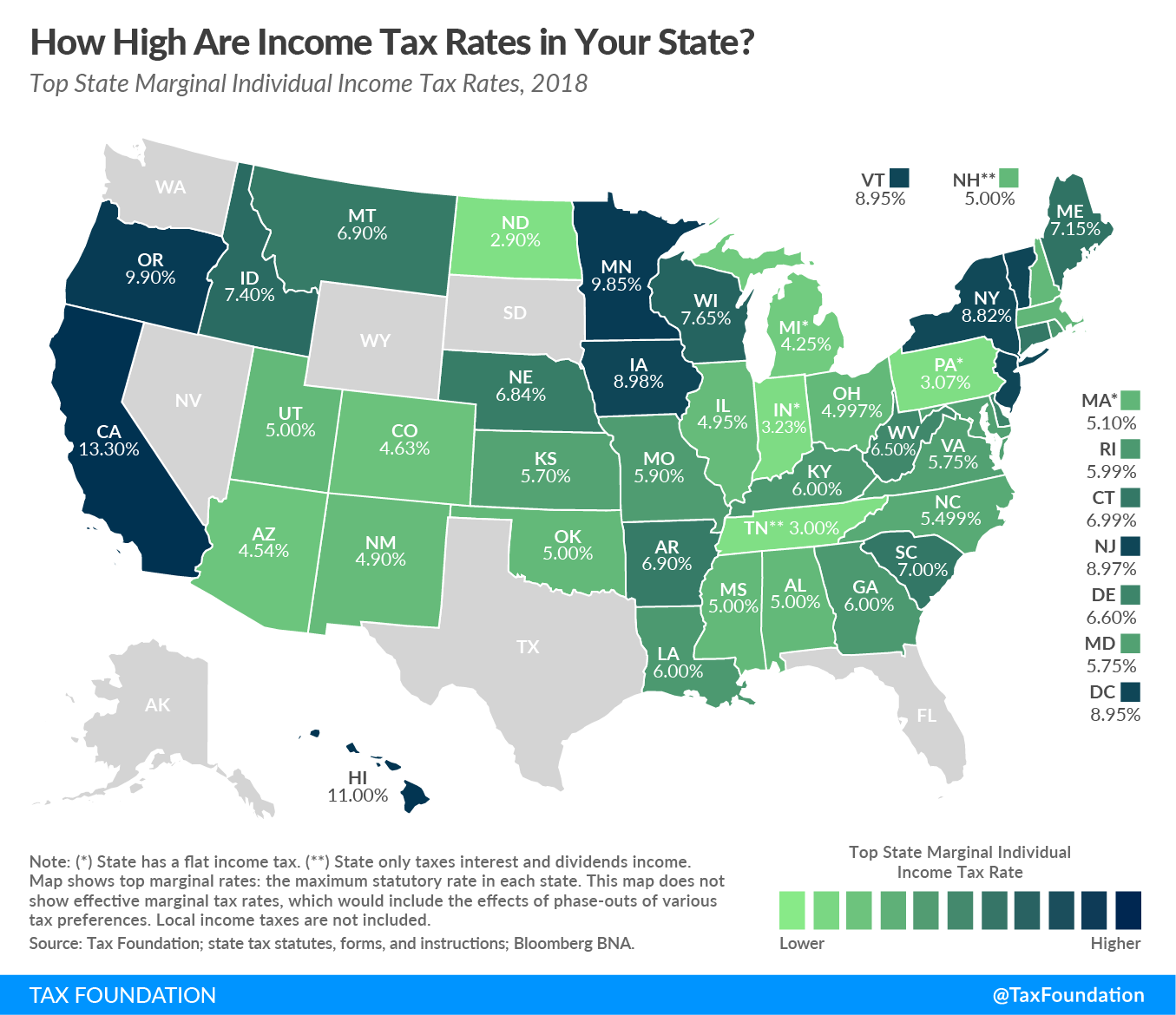

アメリカの所得税 1%の情熱ものがたり, The following corporate income tax rates were effective for tax years beginning on or after january 1, 2025 and before january 1, 2025. How do income taxes compare in your state?

.png)

Monday Map Combined State and Local Sales Tax Rates, The table below lists the income tax rates which will be in effect for tax years 2025 through 2026. This article will further discuss and explain the iowa inheritance tax, how it is calculated, and also changes to the iowa inheritance tax, which gradually reduced starting in 2025, and.

This article will further discuss and explain the iowa inheritance tax, how it is calculated, and also changes to the iowa inheritance tax, which gradually reduced starting in 2025, and.