Franchise Tax Board 2025 Due Date Extension

BlogFranchise Tax Board 2025 Due Date Extension. The internal revenue service (irs) issued final regulations (td 9988) on march 5, 2025, on the direct pay elections for energy credits under internal revenue. The due date to file your california individual or fiduciary income tax return and pay any balance due is april 15, 2025. However, california grants an automatic extension until.

For individual filers, the key date is typically april 15, 2025, to submit their 2025 tax returns. Next, send your request for a federal tax.

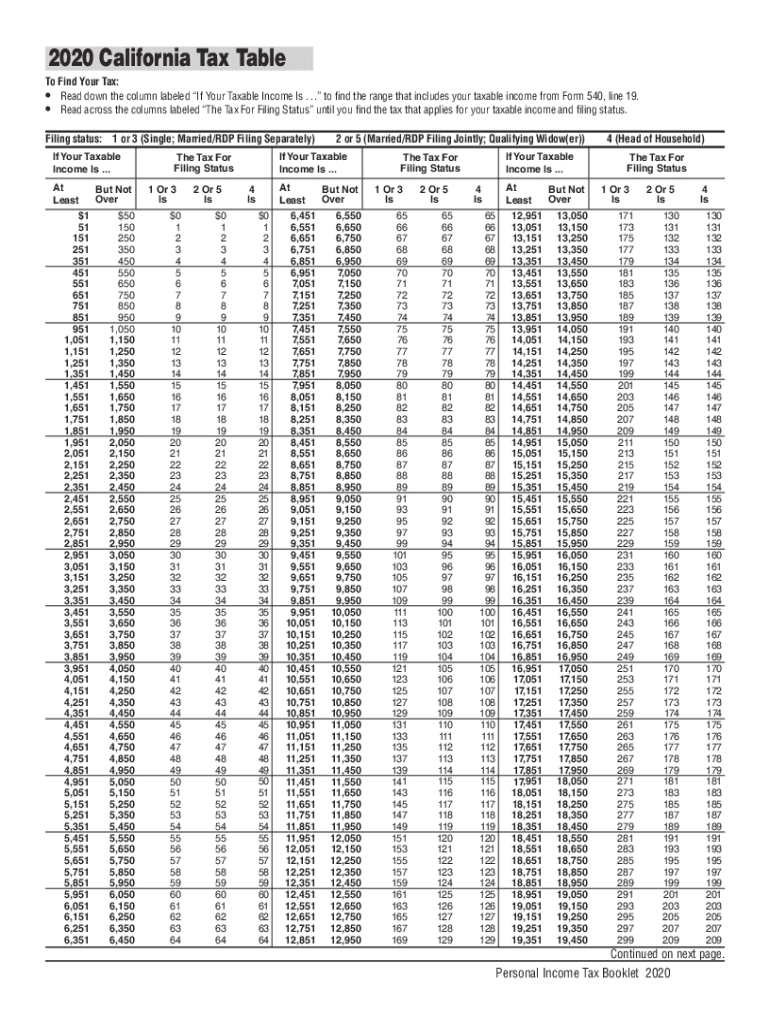

Quarterly estimated tax payments due january 17, 2025, march 15, 2025, april 18, 2025, june 15, 2025,.

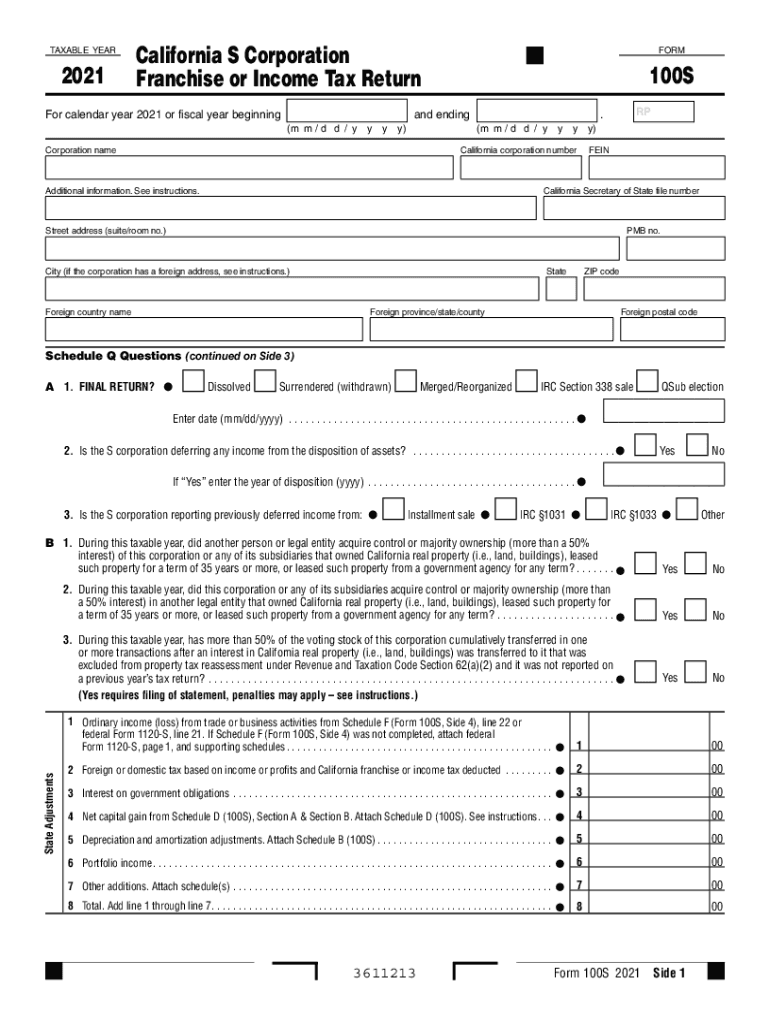

Ca Franchise Tax Board 20212024 Form Fill Out and Sign Printable PDF, You must send payment for taxes in. Need more time to prepare your federal tax return?

Ca franchise board tax Fill out & sign online DocHub, You must send payment for taxes in. Central board of direct taxes (tpl division) sub:

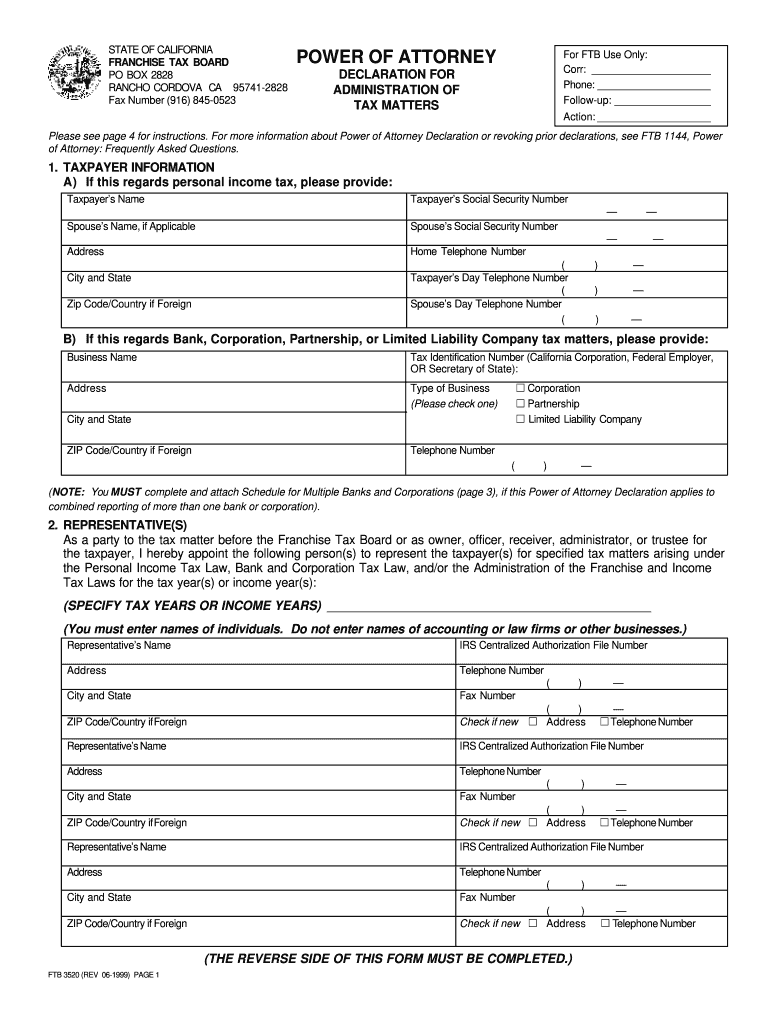

Tax board Fill out & sign online DocHub, Next, send your request for a federal tax. This page provides information on how to apply for an.

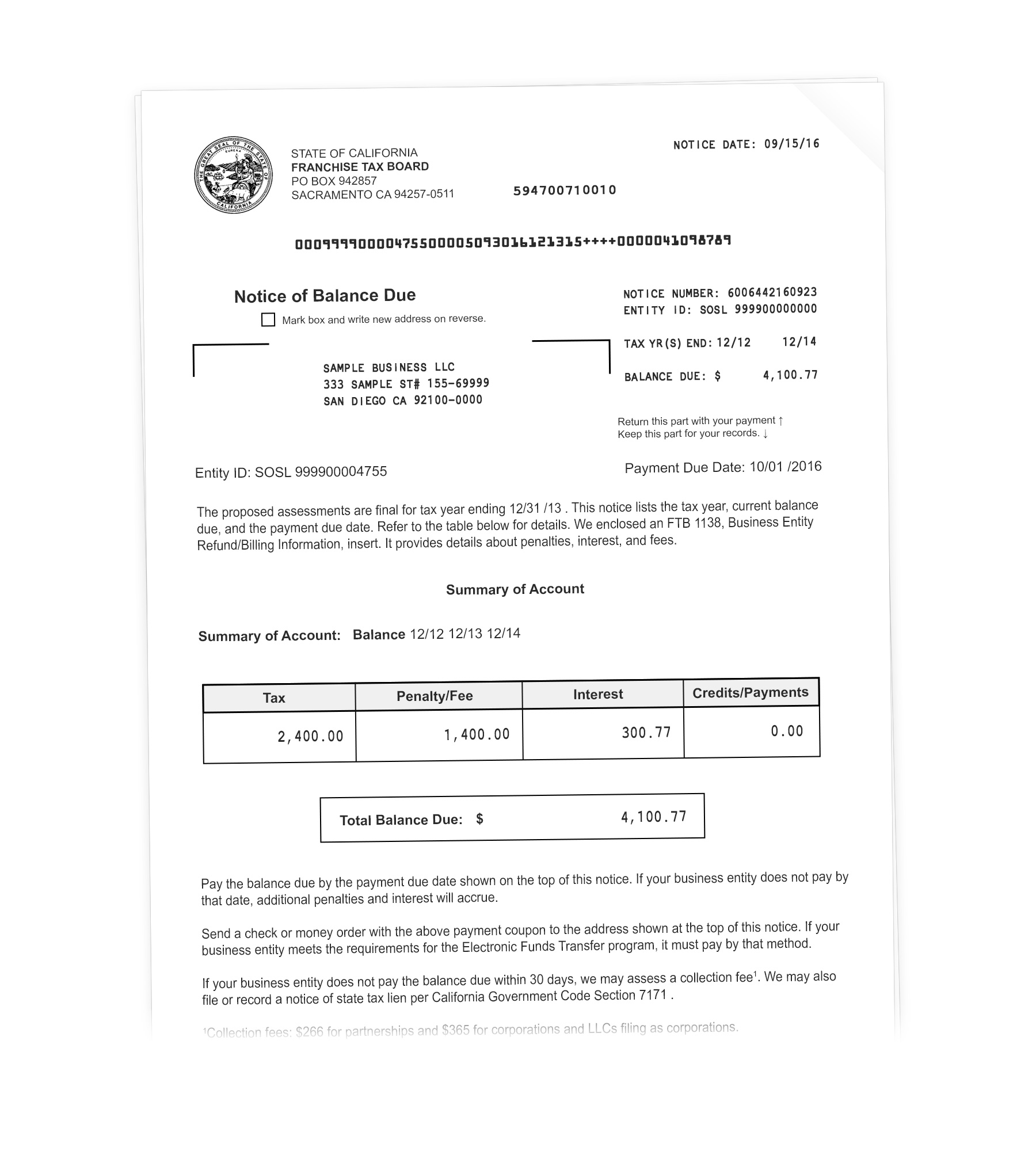

Franchise Tax Board Notice of Balance Due (LLCs) Dimov Tax & CPA Services, For 2025, payment for the first quarter is due april 15, the second quarter on june 17, and the third quarter on september 16. Pay the amount you owe by april 15, 2025 to.

Extended due dates of Tax Return, Tax Audit & TP Audit, Generally, for an extension to be valid, 100% of the tax paid in the prior year, or 90% of the tax that will be due with the current year’s report, must be paid on or. 16, 2025, extended tax filing deadline now have until feb.

GST due date extension for GSTR 1 and GSTR 3B New Tax Route, The very first day of the month marks an important date for tax filers. Form 4070, employee’s report of tips to employer (dec.

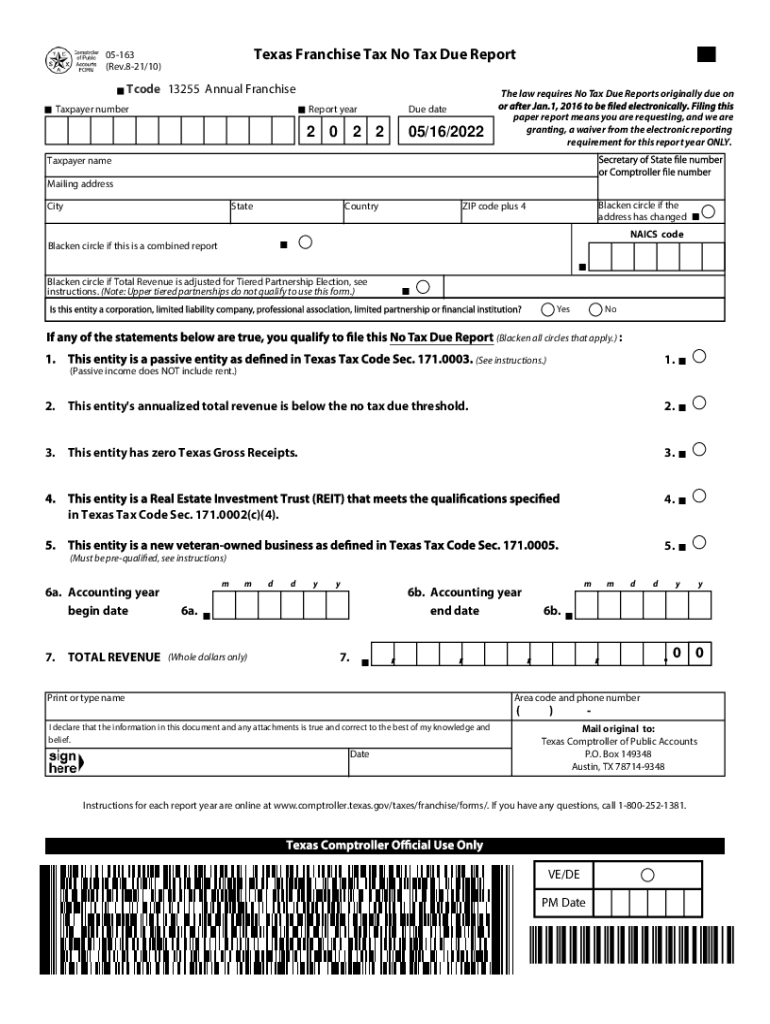

Texas Franchise Tax No Tax Due 20222024 Form Fill Out and Sign, 15th day of 10th month after the close of your tax year. File your tax return for 2025 on or before march 3, 2025, and pay the total tax due.

Tax Return Due Date Extension for AY 202324 Latest News What, The fourth quarterly payment is due the year. 15th day of 10th month after the close of your tax year.

Due date extension under Tax and Benami Law, The internal revenue service (irs) issued final regulations (td 9988) on march 5, 2025, on the direct pay elections for energy credits under internal revenue. Timely means the request is received or postmarked on or before the due date of the original report.

What are the Due Dates for Filing ITR Forms in AY 20232024?, 2025 california state tax deadline: However, california grants an automatic extension until.